Steel prices increasing

We have seen steel prices increasing rapidly and they are showing no signs of slowing down.

Here at Edcon Steel, we wanted to give you a better understanding of the factors leading to these increases, as well as some tips to protect yourself from the changes in market prices.

Raw materials

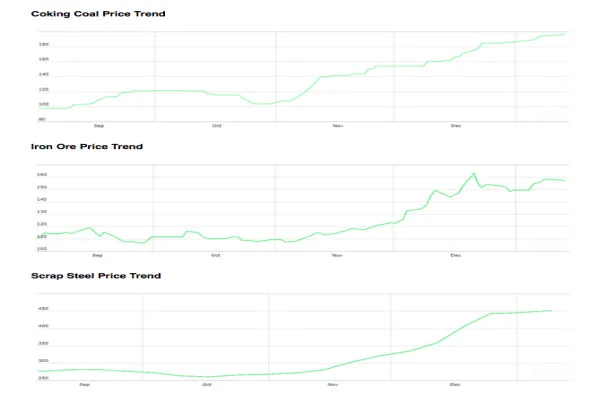

The raw materials essential for the production of steel have seen a surge in price recently, particularly iron ore, coking coal, scrap steel and natural gas.

In January 2021, iron ore reached its highest level since September 2011, largely due to surging levels of demand in China and projected declines in production from Brazil’s Vale mine.

Metallurgical coal and scrap steel prices have been following suit, with hard-coking coal increasing by more than 50% in the last quarter, from US$98 per tonne in November 2020 to around US$150 per tonne last month.

Manufacturing disruptions

These rising prices have been exacerbated by the COVID-19 pandemic, with steel manufacturers hit by ongoing disruptions to manufacturing. Local and international trade restrictions, government-based lockdowns, plant closures and a reduced workforce have all contributed to the ‘stop-start’ production.

Government-based lockdowns across the world, particularly in China, have been particularly disruptive. China manufactures more than half of the world’s steel and, while still recovering from 2020, has received an additional blow by the recent spike in COVID-19 cases in the Hebei Province.

Accounting for 20 per cent of China’s steel production, the Hebei Province has seen the introduction of a host of new restrictions, with some steel mills suspending or restricting production, and some processing plants closed.

Freight interruptions

Government-imposed restrictions have also affected the freight process, with special certificates required for those loading cargo at factories in the Hebei Province, and all drivers leaving the province or sending cargo to Tianjin Port (the main maritime entry to Beijing).

These hindrances have been compounded by logistical issues affecting all seaborne shipping routes from the Asian region – excessively high container freight costs, container shortages, shipping delays, congestion surcharges – which are predicted to remain in place for some time.

These higher costs and lower capacity utilisation, as well as expenses relating to COVID safety protocols, mean cargo is being held at warehouses longer than usual.

Record demand

Adding to the strain on resources is the increased demand for steel, particularly in Australia.

In a bid to stimulate economic growth, governments have introduced measures to boost infrastructure spending, with Australia’s 2019-2020 Budget allocating a record total of $225 billion to general government infrastructure over the next four years.

While this is great for those in the industry, it has driven demand beyond production capability.

What this means for you

While we’ve already seen local steel prices increasing, these things can take time to flow through to the market, so you can expect prices to continue surging in the coming months.

If you are pricing work for later in the year, be very wary of fixed sum contracts based on today’s pricing — it is almost definite that prices will rise dramatically. Conservative forecasting is estimating no less than a six per cent rise, while some are predicting as much as 15 per cent.

It is essential that you factor these predicted price increases into your quotes.