Steel price respite

Although steel prices are continuing to increase, the rate at which they do so is not – a welcomed respite for the steel industry.

This positive update comes amidst challenging global circumstances that immediately impact the import of materials from the likes of China and Russia.

This steel price respite is certainly welcome development and a sign that the effects of international shocks may be settling down and have completed their cycle. We are hoping to see a flattening of steel prices in the future.

It must be mentioned that the rising cost of fuel and energy (electricity) is shaping up to be the biggest mediating factor in the Australian steel industry (as well as many other industries) in the immediate future.

Fuel prices have skyrocketed, and this has yet to fully flow down through the market. The team at Edcon Steel is closely looking at our own costs, as well as freight costs from our suppliers, and fear this will add to our recent round of price rises in material costs.

Silver lining

The recent flooding disasters that have plagued a significant part of the Eastern Seaboard of Australia have not helped either.

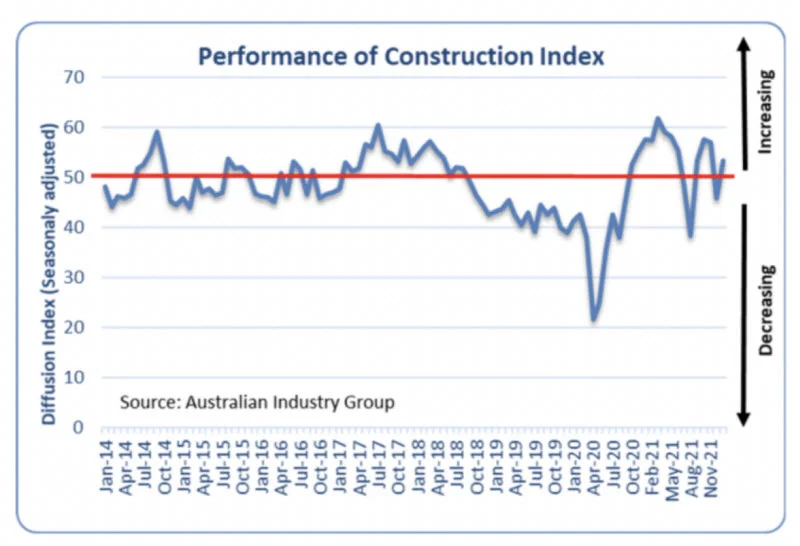

Yet, at Edcon Steel we have observed a silver lining as Australia’s PCI® (Performance of Construction Index) March 2022 review shows a 3.1 point improvement.

This improvement has been attributed to an expansion in construction activity, easing staff shortages and changes to the COVID-19 regulations.

Activity in the domestic residential sector also continues to increase significantly, and Australia’s non-residential construction pipeline remains favourable. With this positive outlook, steel producers and suppliers are looking to invest and improve their equipment and processes.

The investment in the local steel industry is welcome news to Australian steel users, and although customers will not feel the benefits of these investments immediately, it will help customers over the coming years.

Edcon Steel is also looking to invest in improving our business processes to make ourselves as efficient as possible. This includes our recent improvements in our IT systems, crane operations and cutting equipment.

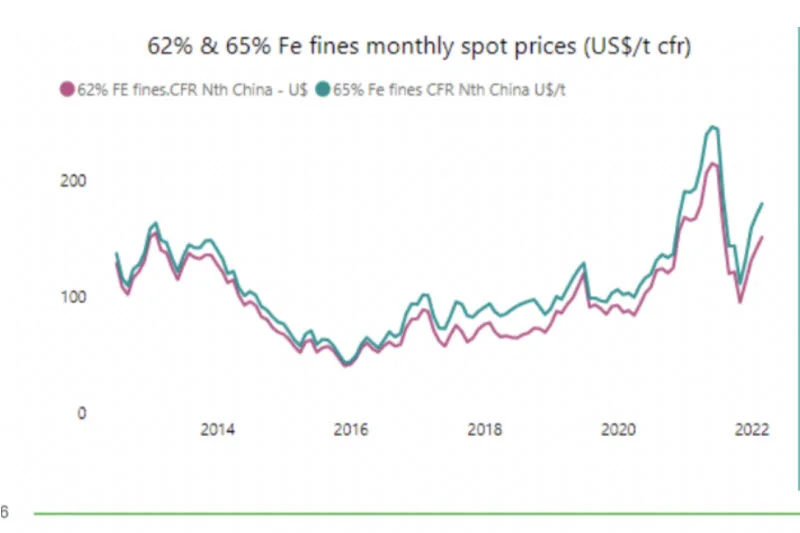

Global circumstances affecting local pricing

Although brass, copper and stainless steel are still subject to pricing pressure, with China’s dynamic zero COVID-19 strategy and continued conflict across Eastern Europe, protracted global changes are worth noting.

Examples of these changes are China’s recent announcement to delay proposed reductions in steel production for environmental reasons to stimulate Chinese economic growth and its commitment to stabilising iron ore prices.

China has also condemned information providers that may be tempted to fabricate price hike information or drive prices up, which will naturally positively affect Australia’s purchasing activity.

Other important factors affecting steel price increases include:

- the increase in iron ore and ferrous scrap prices, due to what has been described as a ‘bullish’ outlook

- the various supply disruptions on seaborne hard coking coal

- the continued conflict in Ukraine, as Russia is the largest exporter of nickel, steel slab and billet globally, and the flow of these products has been interrupted

- sea freight rates currently sitting at 79% higher than this time last year.

As a result, international steel prices are still being negatively affected.

What this means for you

Brass, copper, stainless steel and rural products will continue to face the most considerable portion of the pricing pain; however, positive activity across residential and non-residential industries in Australia is a welcome development for Edcon Steel and its customers.

As Australia’s most comprehensive online steel and metal superstore, Edcon Steel is feeling the brunt of these pricing challenges. This is the most volatile period we have ever witness in the steel industry, with so many factors moving prices in different directions and at different times. This volatility makes predictions of future price changes difficult, but we will continue to keep our customers informed as best we can and maintain our high quality service and comprehensive stockholding.

If you have any specific questions, please contact us.