Steel price update

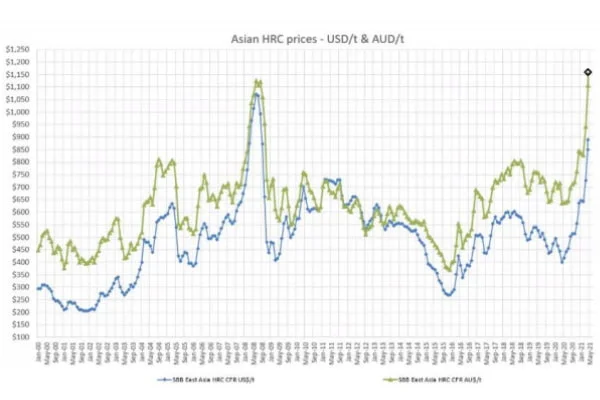

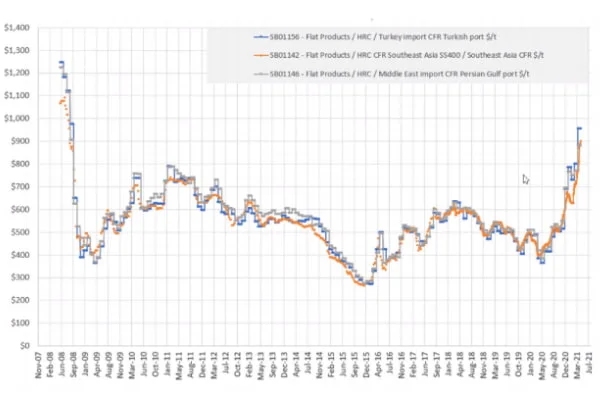

Steel prices are expected to continue increasing.

Edcon Steel is committed to keeping you informed about the factors leading to these increases and providing information as to how you can protect yourself from the changes in market prices.

India’s steel production slows

India is the world’s second-largest steel producer, and the COVID-19 crisis wreaking havoc on the country this year has also presented incredible challenges to its steel producers.

The severe shortage of oxygen across the country forced the Indian Government to restrict the use of liquid oxygen to medical purposes only, as it desperately tries to manage the surge in COVID-19 cases.

As such, steel producers have reduced their oxygen stocks to just half a day, to fulfil the country’s oxygen requirements.

The manufacturing giant’s steel output is expected to drop by more than 20% this quarter because of the lack of oxygen, the restrictions of movement and shortage in available labour.

China rebate withdrawal

Pricing and supply issues have been exacerbated by a recent move by China, the world’s biggest steel producer.

Effective May 1, 2021, China has removed its 13% VAT rebate on 146 steel products, including HRC, hot-rolled sheet, plate, rebar, wire rod, colour-coated steel and cold-rolled sheet with 0.5-3.00mm and below 0.5mm thickness. No changes to rebates have been made to cold-rolled coil and hot-dip galvanised steel.

More than two thirds of total steel exports in 2019 were eligible for the rebate, so it is almost guaranteed that the changes to the rebate will put further pressure on steel prices around the world and alter trade channels. Many analysts are predicting a steel price increase of around 13%.

Shipping delays

The issues plaguing the shipping industry in 2020 have shown no signs of abating, with cargo ships arriving later than ever in 2021.

Delays have been experienced around the world, thanks to large-scale restocking, limited vessel capacity and a shortage of shipping containers.

Shipping executives and container line chiefs expect that the issues will continue for most of the year.

What this means for you

Given the many challenges facing the industry today, it is likely the market will remain tight and continue experiencing steel shortages for the next quarter, at a minimum. This is combined with the all time record prices for steel inputs which are still moving through the supply chain – meaning higher prices and limited availability of the steel you want when you need it.

If you are pricing work for later in the year, be very wary of fixed sum contracts based on today’s pricing — it is almost definite that prices will rise dramatically. Conservative forecasting is estimating no less than a six per cent rise, while some are predicting as much as 15 per cent.

It is essential that you factor these predicted price increases into your quotes.